275: Distressed assets & more JVs: Alex Harrington-Griffin’s 2019 property insights

Please note that we are NOT the original writers of this blog post. All credit goes to the original writers. Find the original post as published at this link: https://www.insidepropertyinvesting.com/podcast-2019-property-insights-developers-boardroom/

Please note that we are NOT the original writers of this blog post. All credit goes to the original writers.

Listen to the episode below: We spoke to Alex Harrington-Griffin over 18 months ago about how his background in marketing was the perfect springboard into real estate investing. He joined us again to discuss what he’s been up to since then and discuss his lessons from sitting developer boardroom meetings over the […]

The post 275: Distressed assets & more JVs: Alex Harrington-Griffin’s 2019 property insights appeared first on Inside Property Purchasing .

Visit FreeRealtyOnline.com to list your home for sale by owner at no charge!

275: Distressed assets & more JVs: Alex Harrington-Griffin’s 2019 property insights

Please note that we are NOT the original writers of this blog post. All credit goes to the original writers. Find the original post as published at this link: https://www.insidepropertyinvesting.com/podcast-2019-property-insights-developers-boardroom/

Please note that we are NOT the original writers of this blog post. All credit goes to the original writers.

The article 275: Distressed assets & more JVs: Alex Harrington-Griffin’s 2019 property insights appeared first on Inside Property Investing.

Listen to the episode below: We spoke to Alex Harrington-Griffin more than 18 months ago. He joined us again to talk about what he has been up to since then and share his lessons from sitting in programmer boardroom meetings over the []

Visit FreeRealtyOnline.com to list your home for sale by owner at no charge!

RBA Announcement – 2 July 2019

Please note that we are NOT the original writers of this blog post. All credit goes to the original writers. Find the original post as published at this link: https://blog.realestateinvestar.com.au/rba-cash-rate-announcement-july-2019

Please note that we are NOT the original writers of this blog post. All credit goes to the original writers.

Statement Governor, by Philip Lowe: Monetary Policy Decision

![]()

Visit FreeRealtyOnline.com to list your home for sale by owner at no charge!

[On-Demand Webinar] How to Create Multiple Income Streams from a Single Property

Please note that we are NOT the original writers of this blog post. All credit goes to the original writers. Find the original post as published at this link: https://blog.realestateinvestar.com.au/on-demand-webinar-multi-income-property

Please note that we are NOT the original writers of this blog post. All credit goes to the original writers.

Multi-income property is a great way to boost your cash flow and balance your portfolio

Dual or multi-income properties can help you achieve this goal. They can provide an investor with more or two incomes, helping to boost your yields, balance your portfolio and increase your serviceability.

![]()

Are you interested in having multiple streams of income from one property?

Find out more in this informative article listed 2nd of July.

Visit FreeRealtyOnline.com to list your home for sale by owner at no charge!

Multifamily Demographics: Five Places to Find Open Source Data Sets

Please note that we are NOT the original writers of this blog post. All credit goes to the original writers. Find the original post as published at this link: http://feedproxy.google.com/~r/multifamilyinsight/EFnh/~3/PSSwXXl5H7E/

Please note that we are NOT the original writers of this blog post. All credit goes to the original writers.

Demographic information is an important component of earning property investment decisions. It is also expensive to acquire. However, there are places on the web that can provide quality information to get you started in the right direction before having to devote dollars to get demographics.

Visit FreeRealtyOnline.com to list your home for sale by owner at no charge!

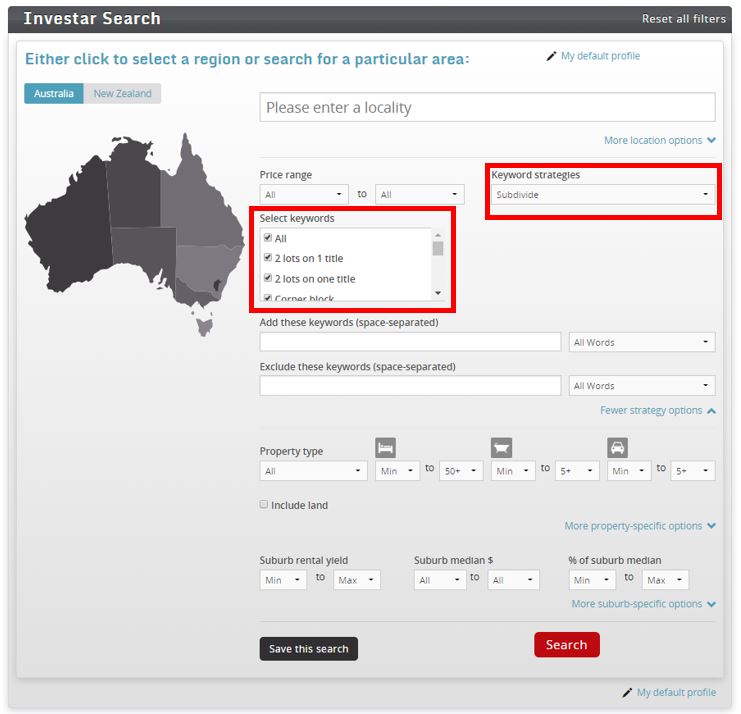

BRAND NEW FEATURE: 2 lots on 1 title keywords added to Subdivision Strategy filter

Please note that we are NOT the original writers of this blog post. All credit goes to the original writers. Find the original post as published at this link: https://blog.realestateinvestar.com.au/brand-new-software-feature-2-lots-on-1-title-keywords

Please note that we are NOT the original writers of this blog post. All credit goes to the original writers.

This is currently available for all current members of Real Estate Investar’s Pro Membership.

![]()

Finding 2 lots on 1 name for subdividing is now even easier as Real Estate Investar has included a number of keywords to help identify these opportunities. The search might even locate a widow block.

Visit FreeRealtyOnline.com to list your home for sale by owner at no charge!

275: Distressed assets & more JVs: Alex Harrington-Griffin’s 2019 property insights

Please note that we are NOT the original writers of this blog post. All credit goes to the original writers. Find the original post as published at this link: https://www.insidepropertyinvesting.com/podcast-2019-property-insights-developers-boardroom/

Please note that we are NOT the original writers of this blog post. All credit goes to the original writers.

Listen to the episode below: We last spoke to Alex Harrington-Griffin more than 18 months ago about how his background in marketing was an ideal springboard into real estate investing. He joined us again to talk about what he’s been up to since then and discuss his lessons from sitting in developer boardroom meetings within the […]

The article 275: Distressed assets & more JVs: Alex Harrington-Griffin’s 2019 property insights appeared initially on Inside Property Purchasing .

Visit FreeRealtyOnline.com to list your home for sale by owner at no charge!

Appreciation versus Cash Flow

Please note that we are NOT the original writers of this blog post. All credit goes to the original writers. Find the original post as published at this link: https://kcinvestmentproperty.wordpress.com/2019/06/11/appreciation-versus-cash-flow/

Please note that we are NOT the original writers of this blog post. All credit goes to the original writers.

- Blue Valley

- Olathe

- Shawnee Mission

Appreciation versus Cash Flow

Nevertheless, per capita and per household income tends to monitor reduced, the school districts rank reduced and there wasn’t the community planning involved in the growth of the city in the early days like there was in JoCo.

Generally speaking, with exceptions to the rule to be found, if you’re searching for a greater cash flow return you might want to be looking in Jackson County, Missoui. If you are interested in investment property and don’t want the cash flow to live on and can wait years until you retire in your profession as an engineer, doctor…whatever… you may find Johnson County, Kansas more desirable.

In the interest of full disclosure, I chose Olathe because I have two children that had some special requirements and Olathe was a far better choice. Blue Valley is an exceptional school district for its talented and Shawnee Mission, although it’s fallen on some tougher times, it time tested and has been exceed when compared nationally.

Following the exact same arguments as above, because the school districts are frequently considered “lessor” the home values tend to trail that of neighboring JoCo. Sure, Lee’s Summit sometimes ranks in that “most livable” category that has a good school district. Yet, it stands alone.

All that’s to say that yes, you should buy smart. You should put money . Yes, you’ll get a lower cash on cash return and yes, you will outpace almost all other areas of the Kansas City metropolitan area in appreciation time and time again. Johnson County is a engine.

Whether you are rich or poor, black, brown or white, muslim or Christian or agnostic, don’t most of us want the best for our kids? Therefore, when you purchase Johnson County, KS rental property just know that because the home values will be higher and therefore the returns will be lower.

Jackson County is a great place to live. And to invest. You’ll get much better cash flow. Appreciation, for the most part, tracks at just above inflation though last year Kansas City was among the highest loving cities in the country at 9%.

Allow me to simplify real estate for you; home values are always powerful and appreciate more centered on the school district.

Here in the Kansas City real estate investing market the conversation turns again and again to whether you should opt for the long term stability of Johnson County, Kansas versus the greater cash flow returns of Jackson County, Missouri. Yes, there are a couple other counties you might choose to invest in. However, these are the big two.

What they all have in common is great school districts. I think most of us who live in JoCo would rank the Big Three school districts in this arrangement;

And make no mistake, it’s not that Jackson County, Missouri is a bad place to maintain income property. Kansas City proper ranks as a fantastic place for the young over and over again, and KC is home to the comforts that bind a city together; art museums, great parks, a revitalized downtown, the Chiefs, the Royals and the Kaufman Center.

Johnson County is the home to cities which constantly show up in the “most livable” reports of the various magazines and sites; Overland Park and Olathe. Nevertheless there are other cities of great import; Leawood, Lenexa, Merriam, Mission, Mission Hills, Shawnee, Gardner…to name a few.

Visit FreeRealtyOnline.com to list your home for sale by owner at no charge!

RBA Announcement – 4 June 2019

Please note that we are NOT the original writers of this blog post. All credit goes to the original writers. Find the original post as published at this link: https://blog.realestateinvestar.com.au/rba-cash-rate-annoucement-june-2019

Please note that we are NOT the original writers of this blog post. All credit goes to the original writers.

![]()

Statement by Philip Lowe, Governor: Monetary Policy Decision

Visit FreeRealtyOnline.com to list your home for sale by owner at no charge!

269: 13 Properties & Counting with Client Ira Boyd

Please note that we are NOT the original writers of this blog post. All credit goes to the original writers. Find the original post as published at this link: http://aipis.hartmannetwork.libsynpro.com/269-13-properties-counting-with-client-ira-boyd

Please note that we are NOT the original writers of this blog post. All credit goes to the original writers.

[8:44] Ira can’t stress enough how much you need to go to an event and how beneficial it will be

www.JasonHartman.com/Properties

Reserve Your Time to Do a Client Case Study!

Key Takeaways:

[2:16] It’s almost better to not see the property, because then you are buying based on intellect rather than emotion

Website:

[13:12] Ira’s strategy for his portfolio

Jason Hartman and client Ira Boyd about his travel in real estate investing talk. Ira started off buying properties on his own, with some success but not as much as he had hoped. After he found Jason’s network, however, he’s gotten in much better properties and is up to 12 investment properties and his personal residence. Ira discusses how live events aided his journeywhere he sees his future in real estate investing, and what areas he thinks he wants to work on.

[17:08] Ira’s policy on rent increases demands work

www.JasonHartman.com/Masters

Visit FreeRealtyOnline.com to list your home for sale by owner at no charge!

![[On-Demand Webinar] How to Create Multiple Income Streams from a Single Property](https://i0.wp.com/realestateclubofamerica.com/wp-content/uploads/2019/07/1491-thumb.png?resize=1140%2C334&ssl=1)